Individuals, families, affinity groups, and corporations can set up their own Donor Advised Fund (DAF), managed by Moore Philanthropy, to make immediate, meaningful impacts in communities across the U.S. and abroad. Our DAFs are for donors at all giving levels who want to give now and with regularity.

Our Donor Advised Fund Services

We offer two kinds of donor advised funds – a traditional DAF or a Mockingbird Account – making this tax-efficient giving vehicle accessible at any supporter level.

What is a Donor Advised Fund (DAF)?

A donor advised fund (DAF) is an efficient and flexible giving solution that provides immediate tax benefits. DAFs allow you to make grant recommendations to the causes you love on your own timetable. Grants can be made to eligible nonprofit organizations in the U.S. or abroad.

Traditional DAF

to open a fund

-

Required annual disbursement (grants under $25K limited to 12 per year. Unlimited disbursements for grants more than $25K)

-

Make grants immediately

-

Assigned fund manager

-

500 minimum grant amount

-

$500 annual fee

Mockingbird Account

to open a fund

-

Required annual disbursement

-

Make grants immediately

-

Assigned fund manager

-

Minimum grant amount (not until $5,000 raised)

-

Year 1: $75 / Year 2: $125

How do we manage your DAF?

The donor makes tax-deductible gifts to their DAF.

The donor identifies and recommends charitable projects and organizations to whom they want to give.

We conduct due diligence on the grant’s eligibility.

We disburse grant funds to fully-vetted nonprofits.

What are the benefits of our DAF?

Support the causes and issues most meaningful to you across the U.S. and abroad.

Tap into our philanthropic expertise.

Customize your fund name - after yourself or in honor of a family member, friend, or an organization.

Keep your giving confidential, if you so choose.

Enjoy low fees and high-touch services.

Give to the DAF in the ways that you want - by check, ACH, wire transfer or donate appreciated assets.

Engage your family members and friends in your philanthropic goals.

Count on our back-office support to issue donor tax receipts, administer grant payments, and ensure compliance when making donations.

What are the fees?

| Asset Amount | Rate |

|---|---|

| First $100,000 | 1.25% |

| Next $400,000 | 1.00% |

| Next $500,000 | 0.75% |

| Over $1,000,000 | 1.25% |

Administrative fees are assessed quarterly. Investment management and consulting fees related to the foundation’s investment pools are charged separately. Special fees may be incurred for international grant recommendations. Third party payment processing fees apply. Additional fees may be charged for any mutually agreed-upon extraordinary legal, banking, or other services rendered on behalf of a fund.

Flexible Grantmaking

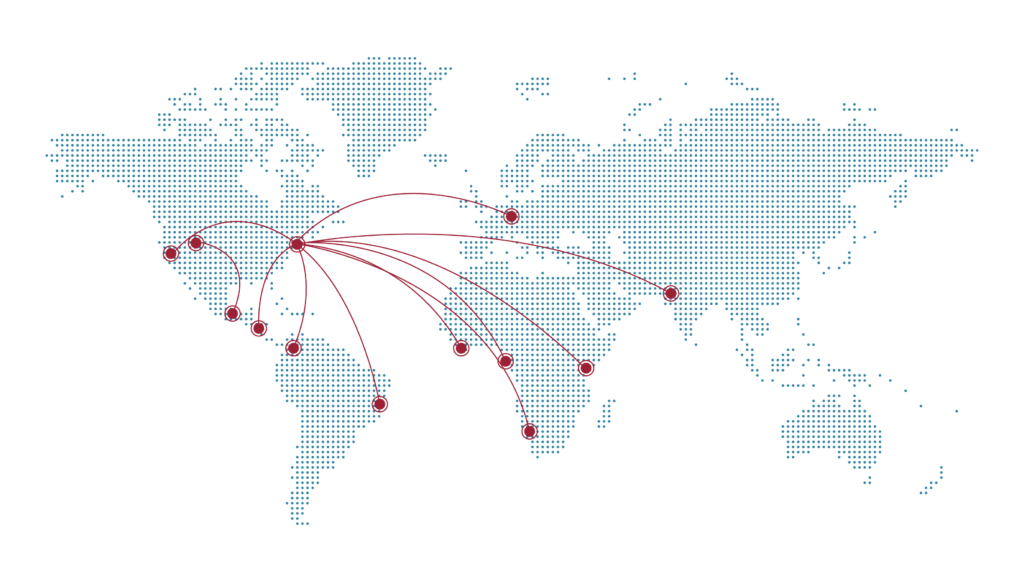

We enable you to recommend grants in the U.S. and internationally. Our staff are located throughout the U.S. to provide you with localized expertise. Our multilingual staff has deep networks abroad having lived in South America, Central America, Africa, Europe and Asia. Our diversity of experience helps streamline your varied philanthropic interests in one fund.

What are the tax advantages of a DAF?

Receive the maximum tax deduction available.

Deduct the value of your gift for tax purposes immediately.

Bypass many of the restrictions imposed on private foundations.

Avoid punitive estate taxes on gifts that you and your beneficiaries make to your fund.

Avoid costly capital gains taxes while realizing the maximum tax-deductions for gifts of complex assets.

Want to establish a Donor Advised Fund? Send us a message by filling out the form below and we’ll follow up with more information.